It could be said that there are a number of factors behind the explosion of creativity in our community of hardware hackers over the last couple of decades, but one in particular that is beyond doubt is the ease with which it has been possible to import small orders from China. See something on AliExpress and it can be yours for a few quid, somewhere in a warehouse on the other side of the world it’s put into a grey shipping bag, and three weeks later it’s on your doorstep. This bounty has in no small part been aided by a favourable postage and taxation environment in which both low postage costs and a lack of customs duties on packages under a certain value conspire to render getting the product in front of you a fraction of the cost of buying the thing in the first place.

A NASTY SHOCK IN STORE FOR EURO HARDWARE HACKERS

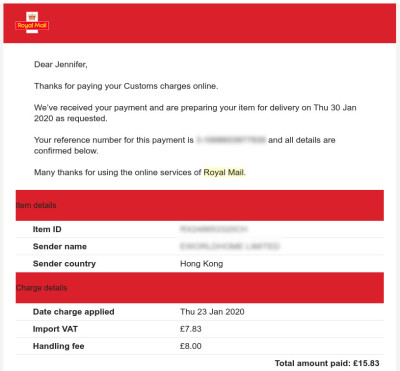

For people in the European Union though, all this could be about to come to an end. The catalyst for it all comes from Commission Delegated Regulation (EU) 2019/1143, which removes the purchase tax, or VAT, exemption on packages with a value less than 22 € and replaces it with a reduced-complexity declaration for packages under 150 €. Suddenly your Arduino clone will come with a VAT bill to pay, and since the current norm is for these charges to be collected by the courier before delivery, you’ll probably also have a hefty handling charge from your post office. The $2 electronic module now has not only a 20% tax added to it, but an extra ten dollars or so just for the privilege of being told that you owe them 40 cents. The days of easy access to the world of imported electronics could be over, and for Europeans at least it looks as though it might be time to step back a few decades.

Of course we’re not just talking about electronics hackers importing component pieces. The seeds of this situation have been sown over several years, with mounting concern over the activities of giant online companies such as Amazon and their use of loopholes in the complex EU tax environment resulting in a loss to the continent’s exchequers in the billions of Euros. This has resulted in a raft of proposals with the unfortunate side effect of gathering up small fry such as our community along with the big fish.

How then are the wheels of international commerce going to keep turning for Europeans after the end of this year? If we had the definitive answer to that we’d probably be off buying superyachts and private islands on our earnings as financial soothsayers instead of covering the world of tech, but it’s fair to say that nobody wants this type of trade to stop abruptly. The problem though is that while this law applies across all 27 EU member states, the VAT regimes of individual states are not harmonised. Thus any attempt to create a centralised VAT scheme in which the tax is prepaid at the point of ordering would run the risk of failure due to complexity.

WILL THERE BE SHIPPING CHAOS?

Larger sellers would be likely to try to circumvent this by locating their distribution infrastructure within the EU and taking the hit of working within the taxation framework rather than outside it. Some companies such as Amazon and Banggood already do this of course, but at the cost of much higher pricing for the EU-sourced item. The chances of a solution of this type that could work for a smaller business are thus not high, as how many AliExpress sellers working from a unit in Shenzhen have the resources to suddenly set up a warehouse in the EU?

Perhaps a new class of business will emerge, one of EU shippers who import orders from China in bulk and who enter into a shipping arrangement with the final customer in which they pay whatever duties are applicable from within the EU. Whatever happens the likely outcome will be that the customer pays more for the privilege of convenient shipping rather than risking an extra service charge to pay the VAT on a direct-shipped product before it can be delivered.

The key to this looming debacle lies in the one detail with which we haven’t been provided, namely how the tax is to be collected under the new scheme. The focus is on making the process easier for both seller and tax authority, with seemingly little thought for the end user. If they can arrive at a solution in which all that need be paid is the VAT itself then the extra 40 cents on our $2 Arduino clone will be of little consequence, but if they allow couriers to continue charging excessive fees for its collection then it will be game over for many of the orders we take for granted. This measure can only truly succeed if it is accompanied by meaningful regulation of these handling charges, otherwise not only will consumers of all types miss out on smaller orders, but the EU will miss out on its intended result of earning all the VAT they would generate.

This is being written not from the EU but from the United Kingdom, at present in the odd limbo of having left the EU but still being in a transitional phase in which we are still working under the same EU rules as before Brexit. Depending on the state of any deal the British government strike with the EU over this year we’ve been told that a tariff-free scheme will operate in the period following a no-deal Brexit, so it’s possible that for once in this context something could be falling in our favour. If so then we look forward to our EU-based friends visiting our hackerspaces to stock up on cheap tech the way we once visited France to stock up on cheap wine, but perhaps the overall benefit of this situation when considering the likely turmoil in other quarters will be marginal. Given that there have also been rumblings in the USA over the low cost of shipping from China, perhaps it’s time we all recognised that the party may to some extent be over.

Source: EU DUTY CHANGES, A WHOLE VAT OF TROUBLE FOR HACKERS?